Economic Charts

Put - Call Ratio Gives Market Bias For Coming Days

Updated: May 06, 2024 | Published: May 05, 2024

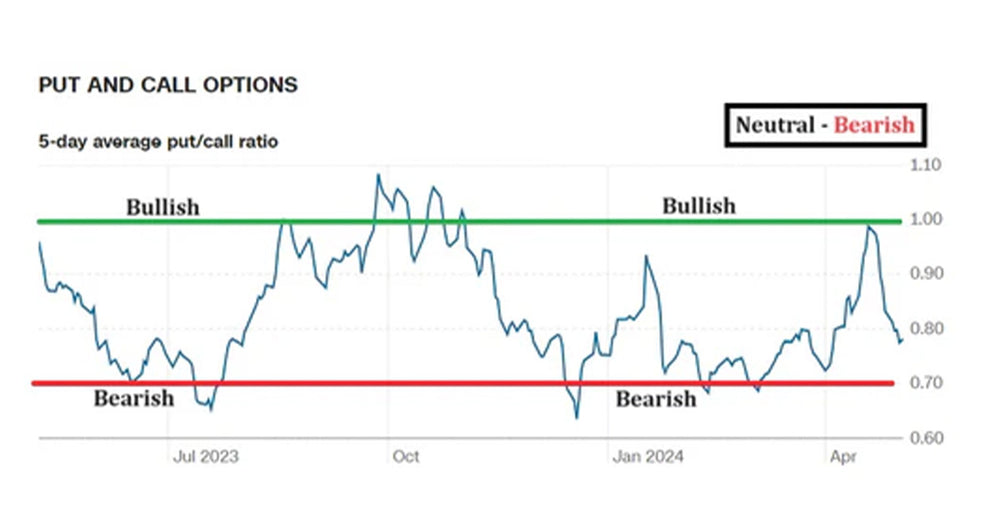

The put/call ratio tells investors how many puts have been bought vs how many calls have been bought. This ratio works as a contrarian indicator at extremes.

When everyone is buying calls, and the put/call ratio is below 0.70, investors should be more cautious or bearish on the markets. When the put/call ratio is over 1.00, it means investors are buying more puts (short stocks) and investors should be more bullish.

The more extreme the number in either direction, the more bearish or bullish.

The current reading of the put/call ratio is 0.80. This signals a higher amount of calls vs puts but not yet to an extreme level. Therefore, the market bias should be neutral to slightly bearish.