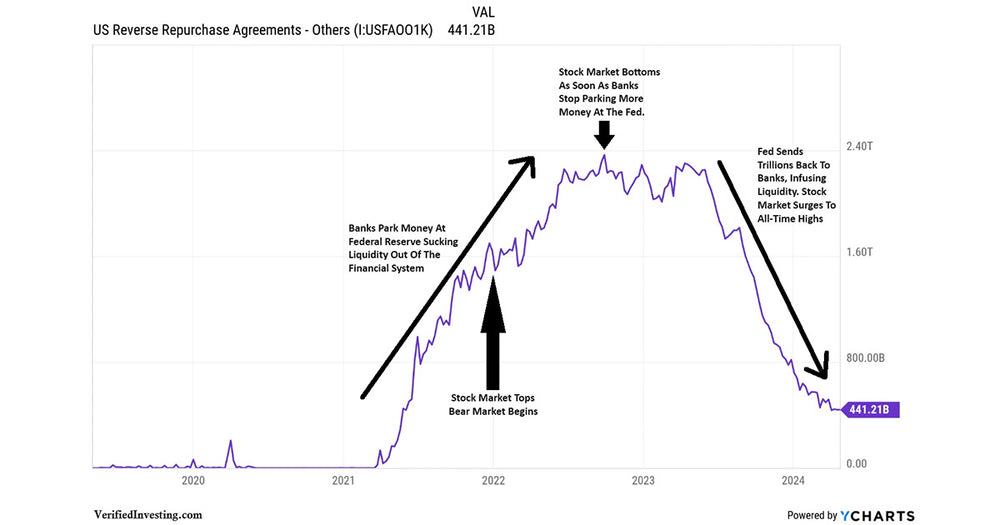

Follow The Money: Reverse Repo And Its Power Over The Stock Market

Reverse Repo is rarely talked about in the financial news media. However, here at Verified Investing our goal is to talk truth and educate investors.

When investing, many will use the term, 'Follow The Money'. That could be nothing more true than with the Federal Reserve and the liquidity it is either pumping into the financial system or pulling out of the financial system.

Reverse Repo allows banks to park money at the Federal Reserve at a certain interest rate. Banks do this to guarantee a return and also to avoid risk. After all, there is no safer place to have your money than with the Federal Reserve...right?

The kicker is that when banks park large amounts of money at the Federal Reserve, they are not lending it out to businesses and people. So essentially it works as tightening financial policy, sucking money out of the financial system.

After a certain period of time, the Federal Reserve sends the Reverse Repo money back to the banks. This infuses liquidity into the financial system.

Looking at the chart above, it is clear that the stock market began topping out as banks began parking money at the Federal Reserve. Then, almost to the day when banks stopped sending money to the Federal Reserve in October, 2022, the stock market bottomed.

As the Federal Reserve sent $2 trillion back to the banks, the stock market went on one of its most impressive rallies to all-time highs.

The bottom line is, follow the money. The more money in the system, the more upside in risk assets. If liquidity is sucked out of the system, the stock market starts heading down.